Irs tax return estimator

Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. Submitting your tax return electronically ensures greater accuracy than mailing your return.

Tax Calculator Estimate Your Income Tax For 2022 Free

If you already filed with TurboTax you would have been able to go back into your tax return and amend it by just adding the additional information from the 1098 form.

. Estimated tax payment due April 15. Available in TurboTax Self-Employed and TurboTax Live Self-Employed. POPULAR FORMS.

Income tax return is married filing separately. Email to eoclassirsgov or. Tax Withholding Estimator helps retirees workers and self-employed calculate taxes fill out new Form W-4.

IR-2021-79 April 8 2021. For more information see e-file options. This product feature is only available.

Businesses can temporarily deduct 100 beginning January 1 2021. Individual Tax Return Form 1040 Instructions. To prevent that notify the Marketplace of the change.

Your premium tax credit is calculated on your tax return using Form 8962. Instructions for Form 1040 Form W-9. To help taxpayers determine return preparer credentials and qualifications the IRS has a public directory containing certain tax professionals.

Instructions for Form 1040 Form W-9. IR-2020-53 March 10 2020 The IRS is encouraging taxpayers to take control of the size of their refund using the Tax Withholding Estimator on IRSgov. This product feature is only available after you finish and file.

IR-2020-95 May 12 2020. The Act added a temporary exception to the 50 limit on the amount that. Request for Taxpayer Identification Number TIN and Certification.

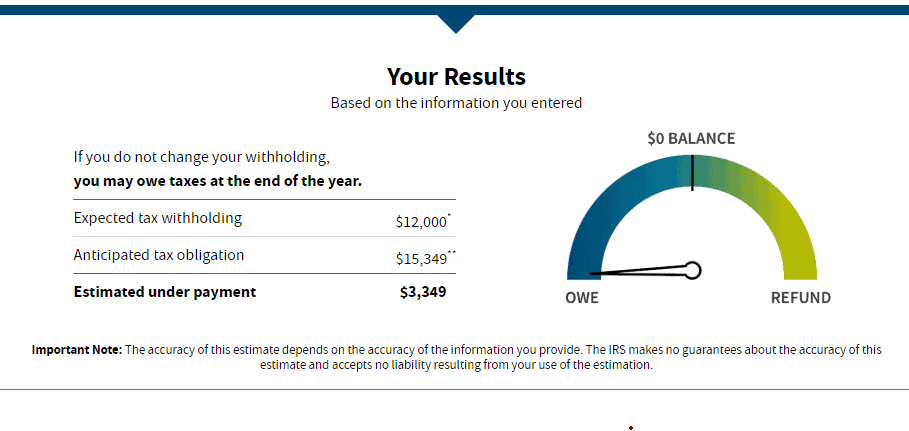

It will help you compare your total expected withholding for 2022 with the combined income tax and employment taxes that you can expect to figure on your 2022 tax return. Make sure your tax return was accepted by the IRS before you amend it. You may also want to send a copy of the referral you send to us to your state tax agency.

Requests may be mailed to the following applicable monitoring site based on where you submitted your initial offer. Individual Tax Return Form 1040 Instructions. The e-file system often detects common errors and rejects your tax return sending it back to you for correction.

Only certain taxpayers are eligible. But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. Mail to TEGE Referrals Group 1100 Commerce Street MC 4910 DAL Dallas TX 75242.

Request for Taxpayer Identification Number TIN and Certification. WASHINGTON The Internal Revenue Service today released guidance to allow temporary changes to section 125 cafeteria plans. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

WASHINGTON The Treasury Department and the Internal Revenue Service today issued Notice 2021-25 PDF providing guidance under the Taxpayer Certainty and Disaster Relief Act of 2020. Situations covered assuming no added tax complexity. Details on this extension are in Notice 2021-21 posted on IRSgov.

Filing an amended tax return with the IRS is a straightforward process. Both signatures are required on the request if the tax return was filed jointly. Then you will be able to go back into the return and amend it.

Check your tax withholding with the IRS Tax Withholding Estimator. Your filing status on your US. You may also use the IRS Tax Withholding Estimator available at IRSgovW4app to estimate the amount of your federal income taxes.

The searchable sortable database includes the name city state and zip code of attorneys CPAs enrolled agents. In addition to oversight by the IRS tax-exempt organizations are subject to oversight by State charity regulators and State tax agencies. This document provides answers to questions regarding return filing and tax payment obligations arising under section 14103 of An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018 PL 115-97 the Act which was enacted on December 22 2017.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. Instructions for Form 1040 Form W-9.

Individual Tax Return Form 1040 Instructions. This could save you delays in processing your tax return. These payments are still due on April 15.

The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. IRS tax forms. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. This tool only gives you an estimate. Memphis IRS-MOIC PO Box 77 Memphis TN 38118-0077.

Notice 2021-21 issued today does not alter the April 15 2021 deadline for estimated tax payments. POPULAR FORMS. If you earned 60 of the combined income you can claim only 60 of the foreign taxes imposed on your income on your US income tax return.

Your premium tax credit may be less than your advance credit payments resulting in additional tax liability to you. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Brookhaven IRS-MOIC PO Box 9006 Holtsville NY 11742.

Situations covered assuming no added tax complexity. This product feature is only available. Only certain taxpayers are eligible.

For more information about the Annual Filing Season Program visit the Tax Pros page on IRSgov.

Tax Refund Estimator Calculator For 2021 Return In 2022

Tax Withholding Estimator Shortcomings Virginia Cpa

Do I Need To File A Tax Return Forbes Advisor

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Aicpa Irs Extends Income Tax Day To May 17 But Small Businesses Still Could Be Held To April 15 Repairer Driven Newsrepairer Driven News

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

3 11 10 Revenue Receipts Internal Revenue Service

Irs Notice Cp17 Refund Of Excess Estimated Tax Payments H R Block

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Iatse Local 479 When To Expect A Tax Refund During The Government Shutdown Dedicated To The Representation Of Every Worker Employed In Our Crafts

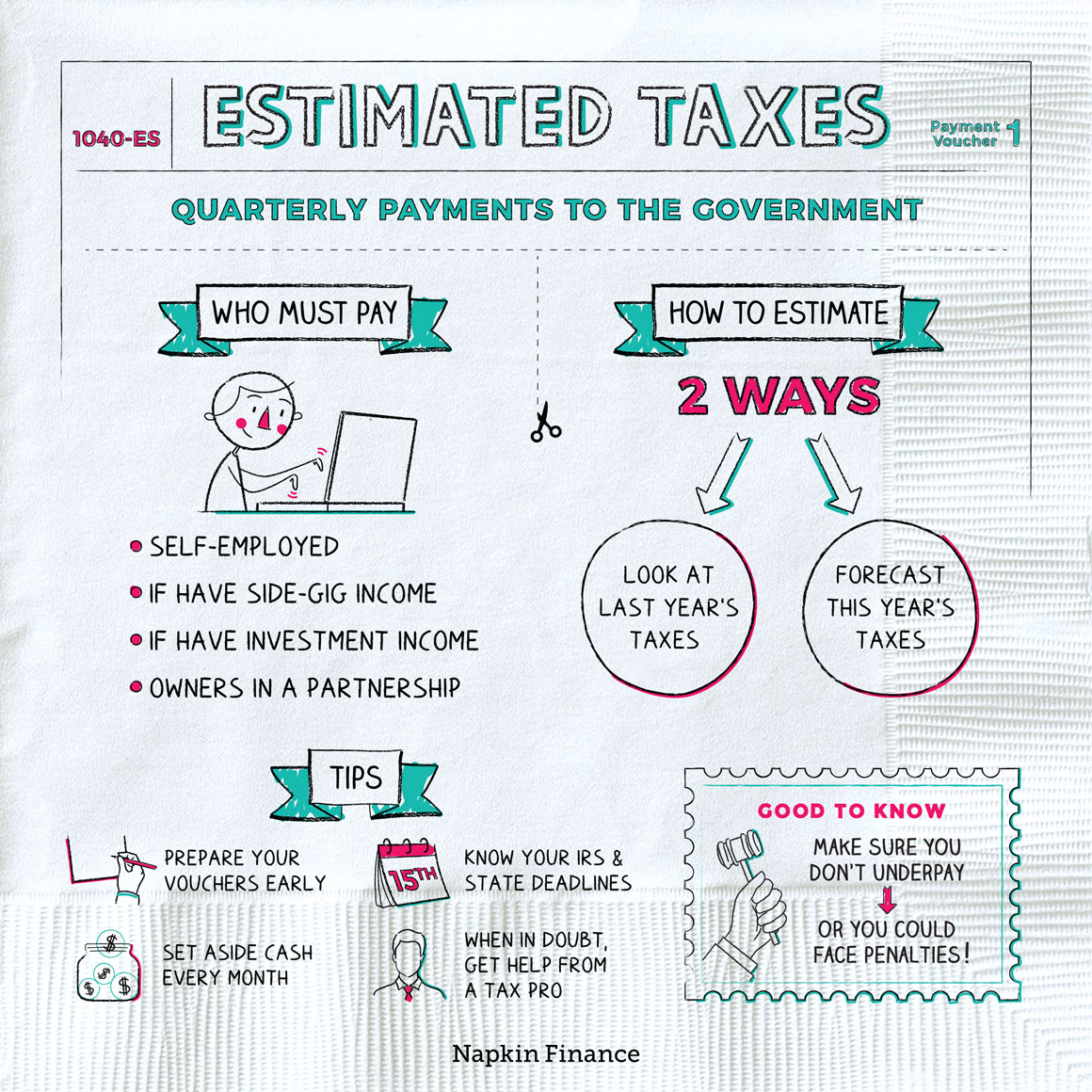

What Are Estimated Taxes Napkin Finance

Tax Refund Calendar Date Calculator

How To Calculate Federal Income Tax

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

See Your Refund Before Filing With A Tax Refund Estimator